On their website, American Airlines credits NDC with their ability to deliver superior retailing through third-party distribution partners. NDC (New Distribution Capability) is a data exchange format based on offer and order management processes for airlines to create and distribute relevant offers to their customers regardless of the seller chosen.

Despite the fact that the “N” in NDC stands for “new,” it’s actually getting rather old. In fact, it’s about to turn 15, and American Airlines is one of the only major airlines to leverage the format in a meaningful way. Many other airlines have also embraced the NDC approach including Air Canada, Air France–KLM, and Lufthansa, but most aren’t there yet. Why such a slow pickup? The reason is simple—the industry has long talked about NDC as an innovation that replaces current data and technology, but few airlines want to rip out the data and technology that runs their entire sales operation.

American Airlines proves there can be another approach. The airline has built their solution on top of their current fare process, utilizing ATPCO’s Routehappy merchandising solution in the process. This approach is not only successful but it’s also well within reach, which makes it significantly more valuable today than the concept of a completely transformative NDC approach that requires brand new data and connections that might not be the norm for years to come.

NDC is an evolution, not a revolution

The promise of NDC is that airlines can have more flexibility and control over the experience that shoppers have on not only their own sites, but also on third-party distribution sites. A full-fledged NDC roll-out should enable airlines to deliver more relevant, personalized offers to flight shoppers at an individual level—even in real time—anywhere they are shopping.

One of the reasons that airlines have been slow to adopt NDC is that it was originally launched as an alternative to current processes, which created a misconception that it couldn’t be built on top of existing data and technology solutions. That couldn’t be further from the truth.

While direct connections to travel agencies have been around since the 1990s, it took some time for technology to catch up with the business model to improve it. Before American Airlines, several other airlines, technology providers, and online travel agencies started playing with the NDC format (or a version of it) notably using Open AXIS, which was spearheaded by ATPCO as an industry solution, and donated to IATA to industrialize. Pioneers like Air Canada and Qantas were “kicking the tires” for years before IATA’s program by using existing data structures.

Several airlines have enabled NDC to deliver tailored offers like those delivered on their own direct website and mobile apps, and they cleverly used infrastructure to try out the market as quickly as possible, including these notable examples:

- Lufthansa Group used carrier-imposed fees data and standards to implement their new distribution policy to move toward NDC.

- Air France–KLM are aiming, founded on traditional data structures, at 80 percent NDC in their domestic network by the end of 2023.

- British Airways is moving to seamless customer servicing using Voluntary Changes and Voluntary Refunds policy content and standards.

The common thread? It can be done faster and better if the industry evolves together.

Here’s one proof point: Lufthansa provides an API connection for partners to connect to their offer and order management system, and they are amassing a number of integrated partners including Amadeus and TravelPerk.

Each of these examples uses the data and tools already in place to distribute airline fare information, which proves that a concept like NDC doesn’t happen with the flip of a switch, but instead emerges organically, albeit slowly, as part of the current ecosystem.

Build toward the future of NDC

After a decade and a half of fits and starts, American Airlines provides a great blueprint for a realistic approach to NDC: one that not only works but is attainable through leveraging the data and tech in place today. The airline industry is incredibly complex with highly regulated data that flows through many layered systems and technologies.

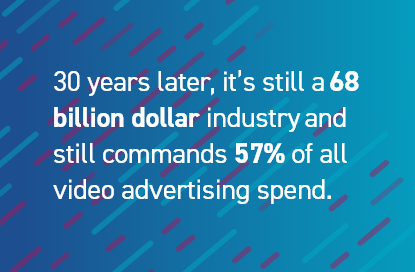

It’s very similar in this way to television advertising, which has been predicted to die since 1995 when the first digital advertisement was introduced. In reality, nearly 30 years later, it’s still a USD 68 billion industry and still commands 57 percent of all video advertising spend. It also still relies on Nielsen ratings and uses many legacy technology systems to deliver, measure, and bill the ads.

The moral of the story is not that old habits die hard, but that huge, complex industries evolve slowly, even in the face of new innovations. The changes in these industries prove over and over that comprehensive content and data standards power this evolution.

For airlines, this lesson is really an opportunity. Rather than wait until they can rip everything out and implement shiny new tech, airlines can embrace NDC today and build on what they have in place. NDC doesn’t have to be a promise that we can’t deliver on, we just need to rethink our approach. By innovating within our existing ecosystem, we will deliver a better customer experience sooner, which was really the goal in the first place.

Want to help define the path forward and define adoption of NDC? Join ATPCO’s NDC Solutions Design Team.